Disadvantages Of Single Entry System

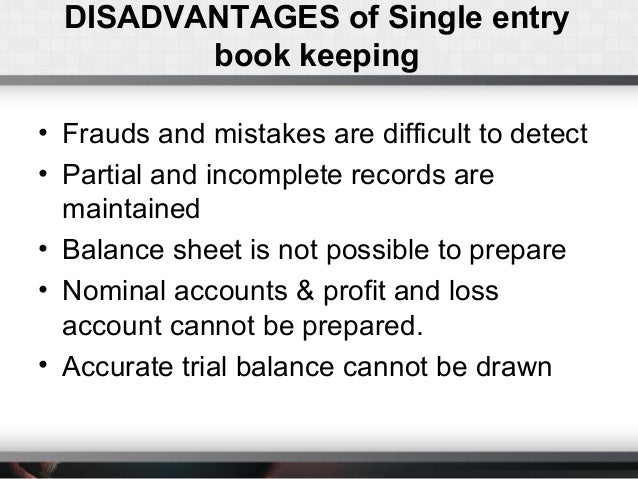

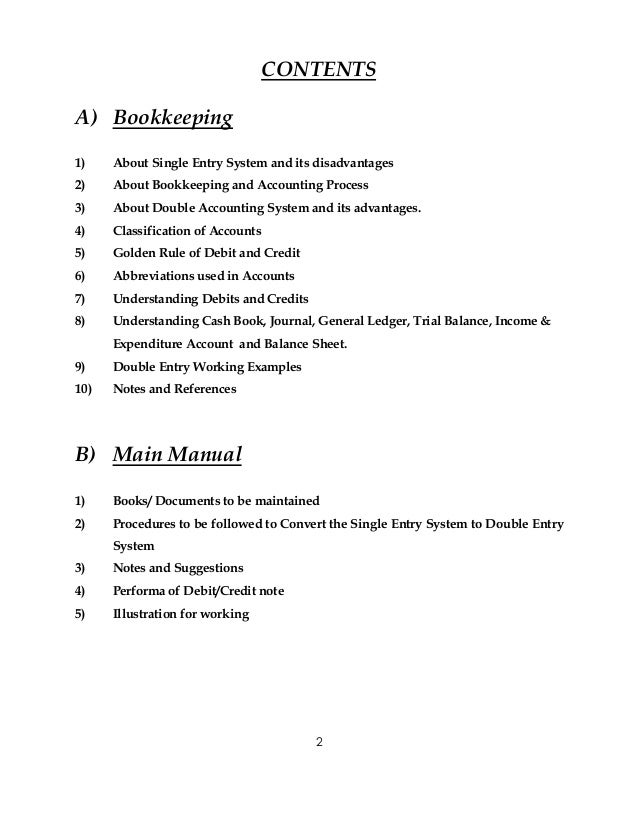

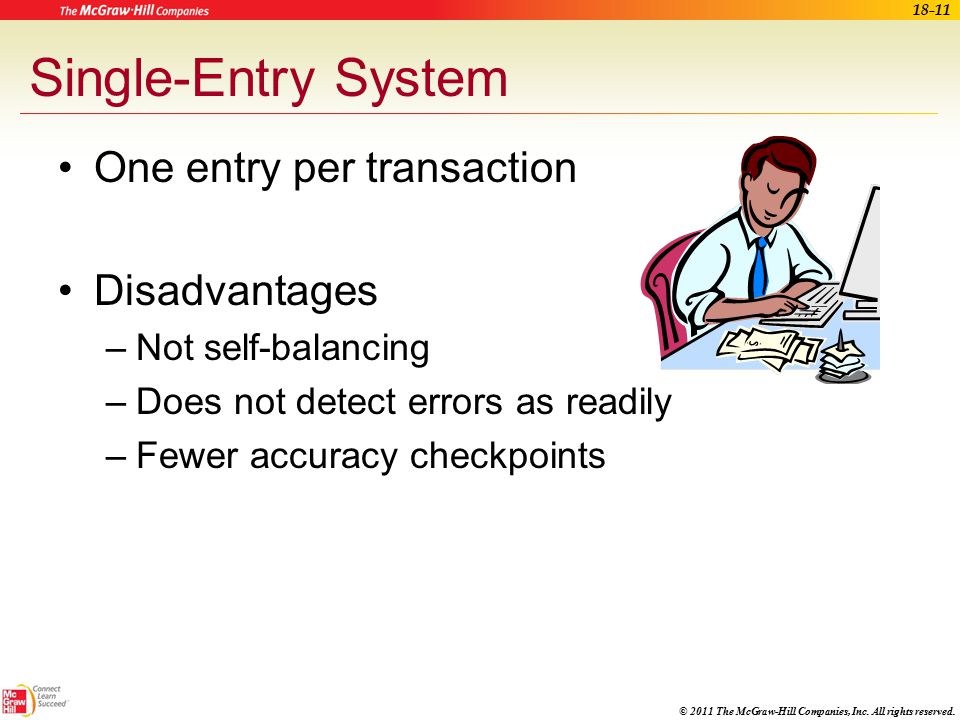

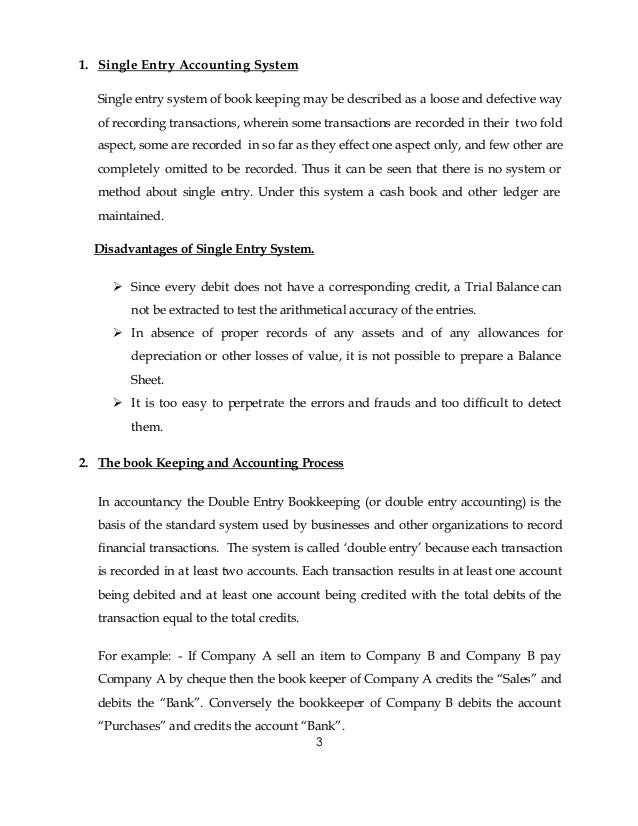

Disadvantages of single entry system. Therefore it becomes extremely difficult in verifying and checking the arithmetical accuracy of the books of accounts so prepared. Disposal of Fixed Assets. Disadvantages of Single Entry System.

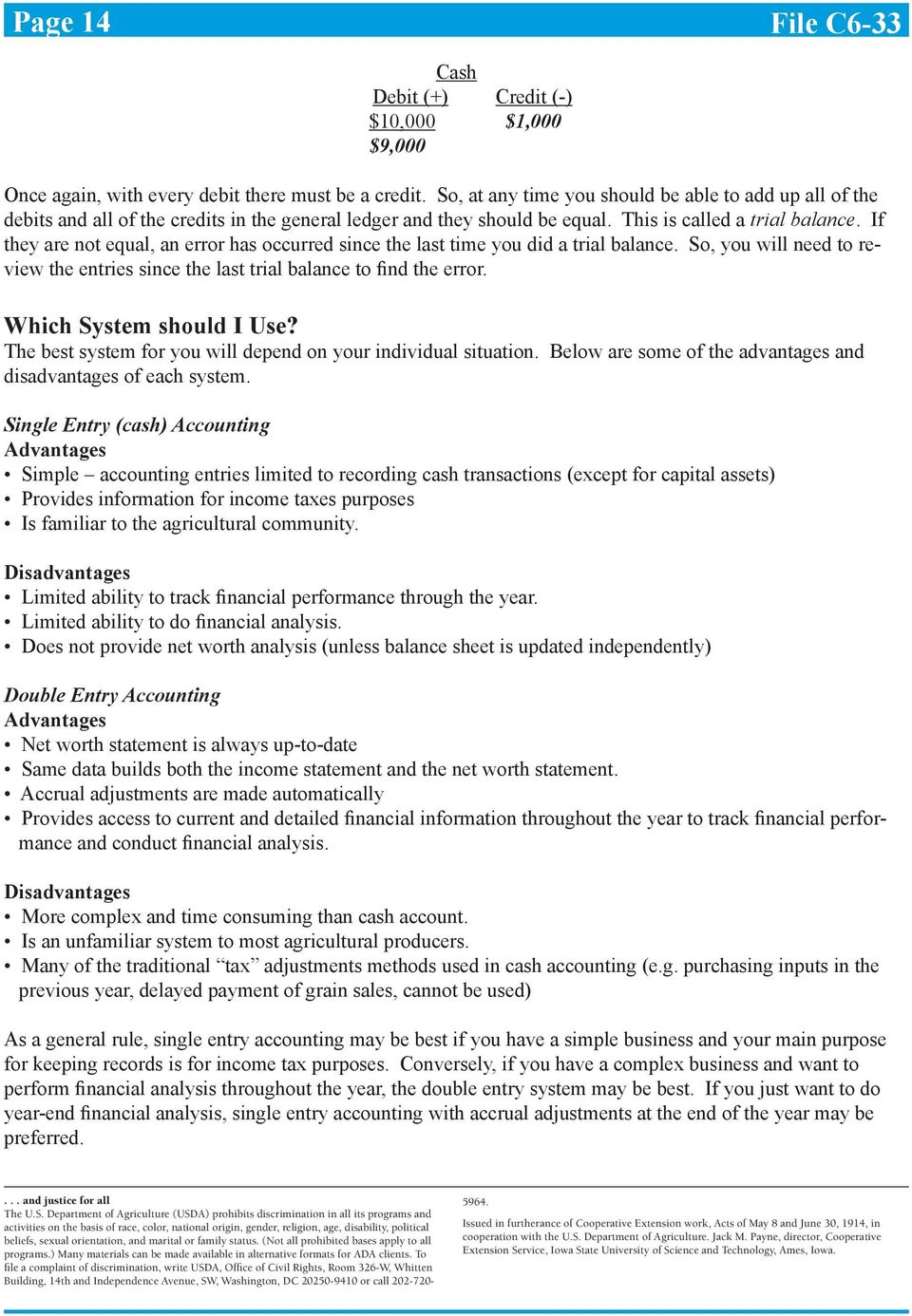

Companies that deliver goods and services and receive payment on different dates may also find that the single-entry system doesnt suit their needs. Profits can be easily determined in single entry bookkeeping by a comparison between the closing and the opening balance of the given period. Discount Received And Discount Allowed In Accounting.

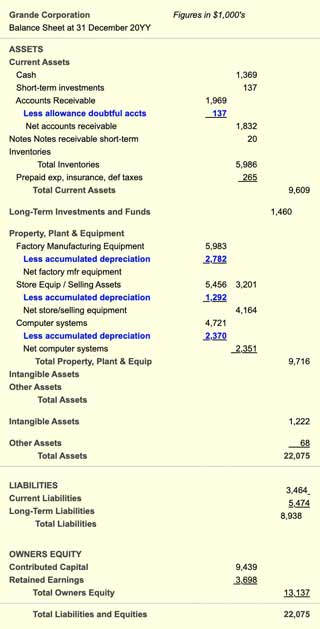

Nor can itby itselfgive owners and managers crucial information for evaluating the companys financial position. Disadvantages of a Single Entry System. In addition it can be used to derive the profits generated by a business in short order.

That errors in accounts rendered by single entry system are not easily traceable. All in all the single-entry system makes it harder to get the full picture of your companys financial standing. It is not a proper method as compared to double entry system as it doesnt fulfil all the accounting concepts.

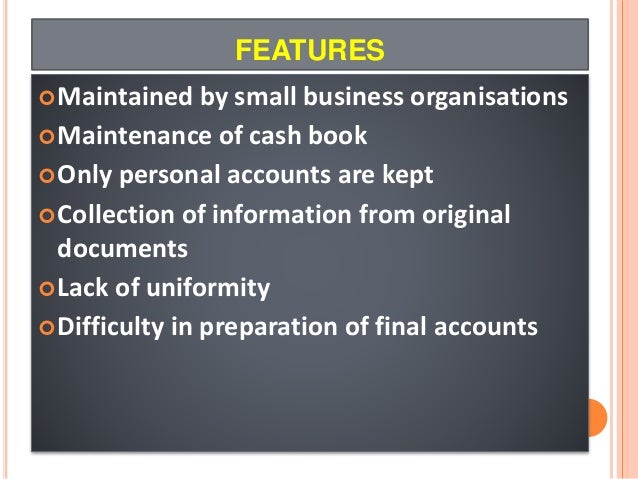

That it is an incomplete system of accountancy. A small businessman can make simple lists of his assets liabilities bank balance and debtors and creditors on note book under single entry system. Disadvantages of Single Entry System.

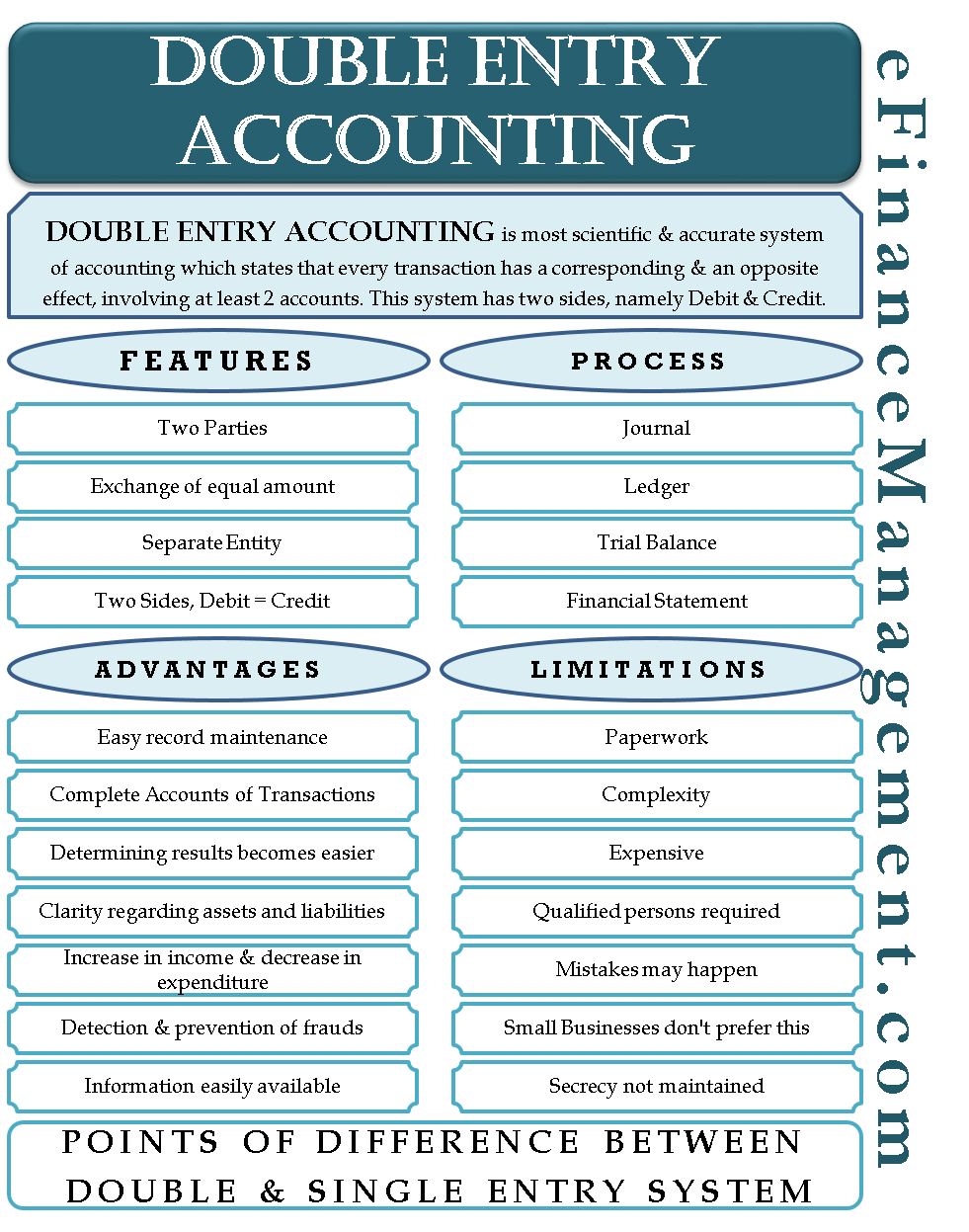

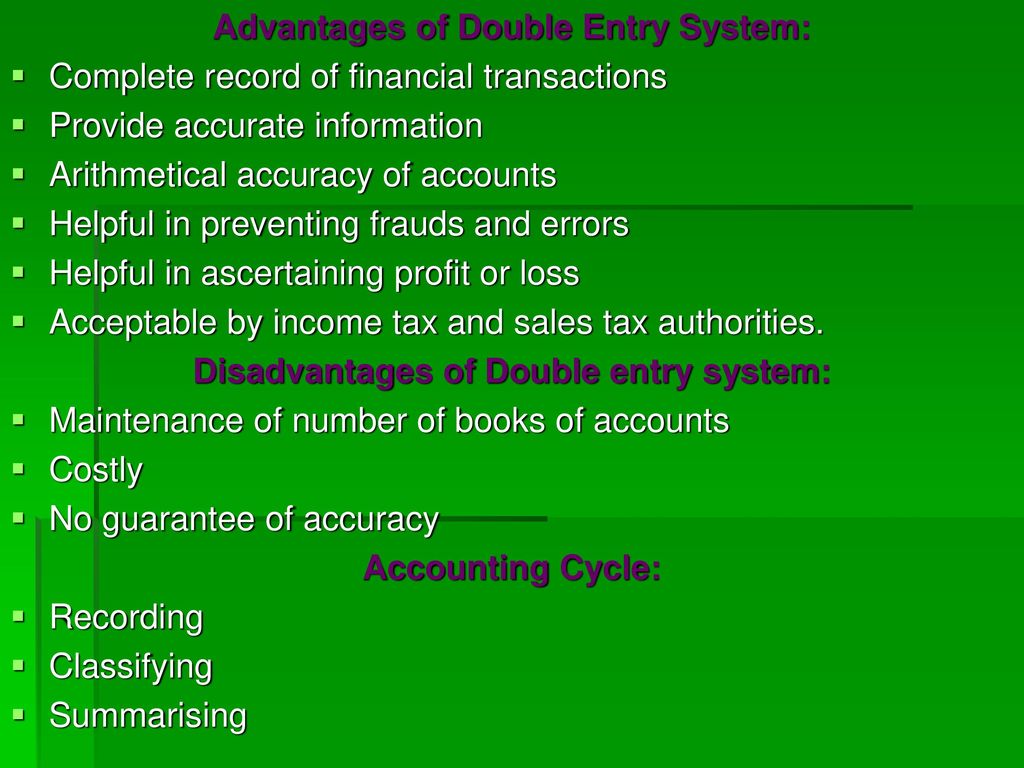

The system is much more complex and harder to implement. Under this system Trial Balance is not prepared. Every transaction needs to be entered twice and double-checked.

Dishonour of Cheque Journal Entry. Net ProfitNet Loss cannot be ascertained as nominal accounts are not maintained.

Single entry bookkeeping is prone to.

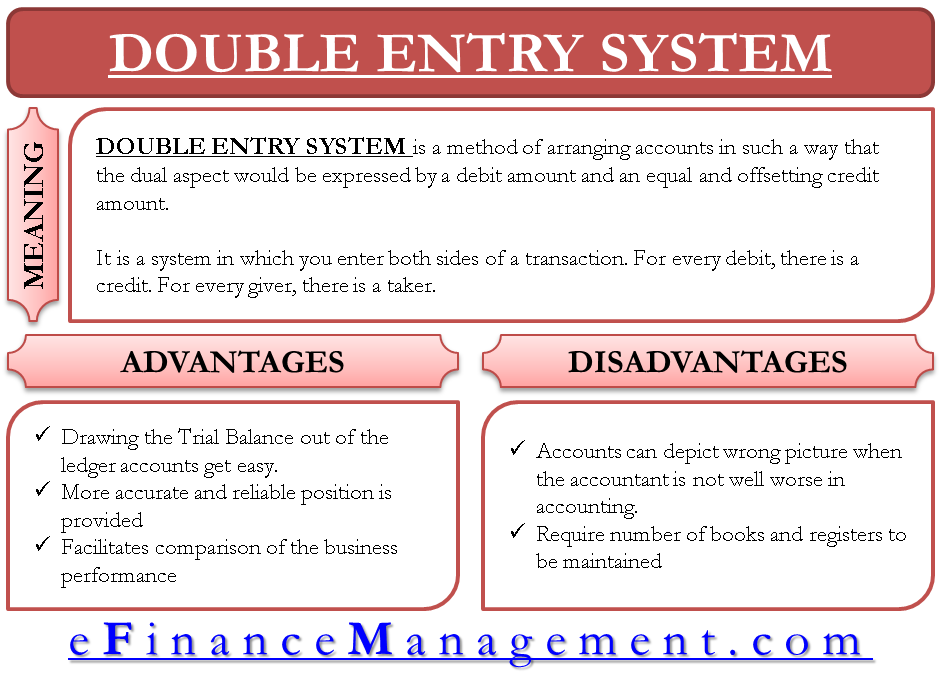

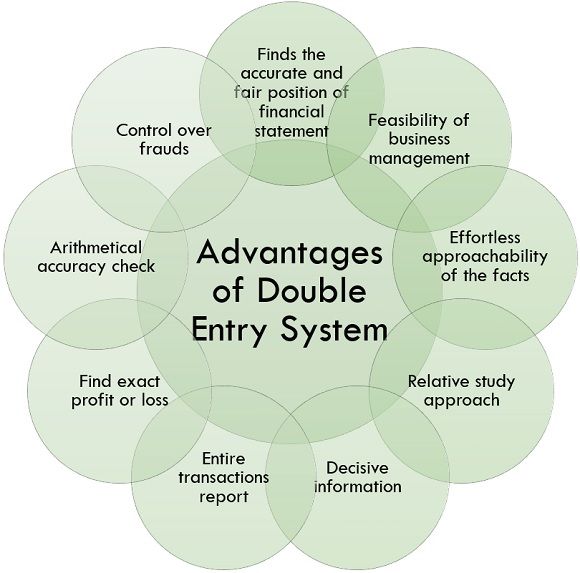

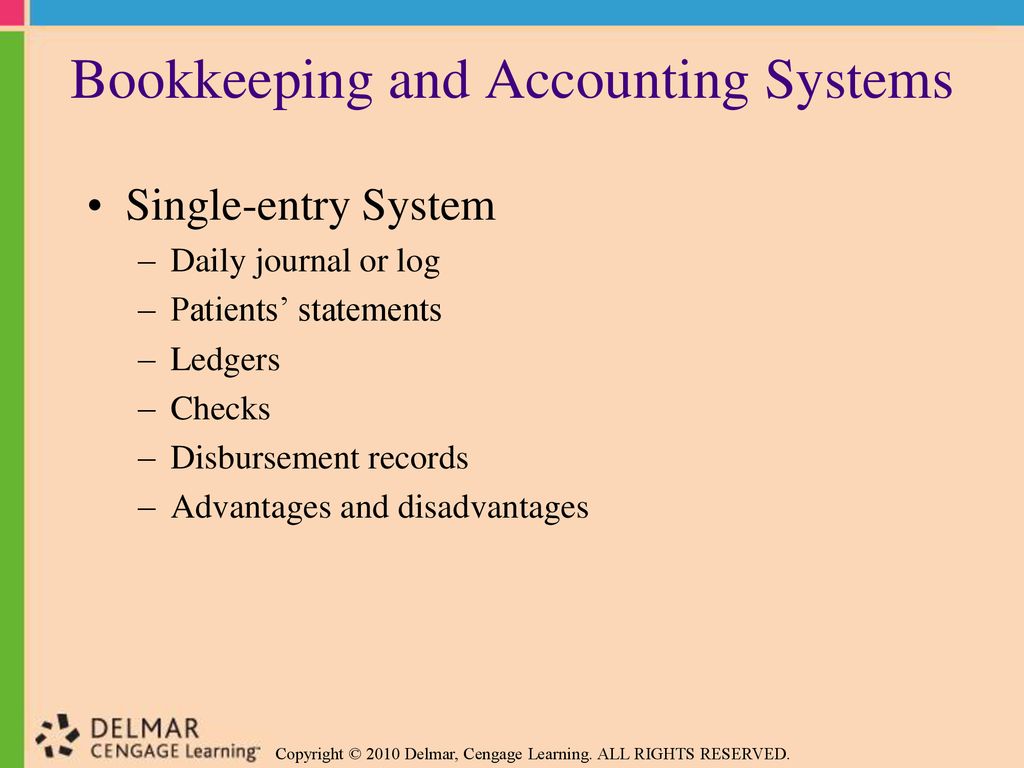

Nor can itby itselfgive owners and managers crucial information for evaluating the companys financial position. Disposal of Depreciable Assets. The financial records being incomplete make it impossible to extract a Trial Balance to check the arithmetical accuracy of the entries. Disadvantages of Double Entry System. Single entry system ignores dual aspects debit and credit of transactions. Discount Received VS Discount Allowed. Single-entry bookkeeping or single-entry accounting is a method of bookkeeping that relies on a one-sided accounting entry to maintain financial information. Under this system Trial Balance is not prepared. Disadvantages of Single Entry System.

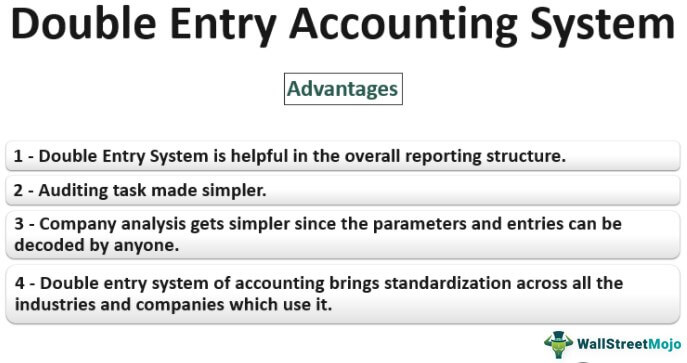

In addition it can be used to derive the profits generated by a business in short order. All in all the single-entry system makes it harder to get the full picture of your companys financial standing. Costly Double entry system can be activating by manual or computerized method but both are costly. Disadvantages of Single Entry System. In addition it can be used to derive the profits generated by a business in short order. Errors of omission. Single-entry accounting provides insufficient records and insufficient control for public companies and other organizations that must publish audited financial statements.

.jpg)

Post a Comment for "Disadvantages Of Single Entry System"